New Delhi [India], June 22 (ANI): India's oil and gas sector is poised for a nuanced fiscal performance in FY24, with anticipated declines in downstream profits contrasting with robust upstream growth, according to the latest analysis from Fitch Ratings.

Fitch projects a 3 per cent-4 per cent increase in India's petroleum product demand for the fiscal year ending in March 2025 (FY25), buoyed by rising consumer, industrial, and infrastructure needs.

This is in tandem with an expected GDP growth of 7 per cent. Diesel and petrol will continue to dominate the consumption landscape, accounting for over half of the overall demand, which grew by 5 per cent in FY24 and 2 per cent in the initial months of FY25.

Indian oil marketing companies (OMCs) are anticipated to maintain steady marketing margins in FY25.

Despite a forecasted dip in Brent crude oil prices to USD 77.5 per barrel from USD 82 in FY24, margins should remain stable.

This stability is expected even in the face of a recent INR 2 per litre cut in diesel and petrol prices, the first such reduction in nearly two years.

However, Fitch warns that rising crude prices amid geopolitical uncertainties could apply pressure on these margins.

OMCs are expected to see a reduction in their EBITDA from FY24's peak levels, driven by steady marketing and softening refining margins.

This moderation is attributed to weaker product cracks, reduced exports from Asia, and lower benefits from crude price differentials, despite a decline in special excise duties on diesel and aviation fuel exports.

The upstream segment is expected to remain robust, with low-single digit percentage growth in oil and gas production supporting strong cash flows.

Key players like Oil and Natural Gas Corporation Limited (ONGC), Oil India Limited (OIL), and Reliance Industries Ltd (RIL) will benefit from elevated crude prices, even though they may not reach FY24 highs.

In FY24, domestic oil and gas production rose by 3 per cent, bolstered by a 6 per cent increase in gas output.

Fitch anticipates high capital expenditure (capex) levels among industry players.

Upstream companies are likely to maintain high capex to drive production growth and ensure reserve adequacy, while sovereign-backed downstream entities are set to invest heavily in refining, petrochemical, and retail capacity expansions.

Investments in energy transition initiatives are expected to rise gradually across the sector.

India's crude oil production is forecasted to grow by mid-single digit percentages in FY25, driven by production increases at ONGC's and RIL's offshore fields in the Krishna-Godavari Basin, and technology-driven output stabilization efforts at mature fields.

Despite this growth, the country's dependence on crude oil imports will likely increase, as consumption growth is set to outpace domestic production.

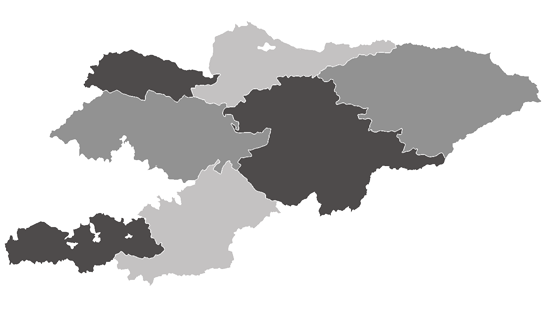

In FY24, India's crude oil import dependency climbed to 87.8 per cent, up from 87.4 per cent in FY23, with Russia emerging as the largest oil supplier, accounting for 36 per cent of imports.

India's natural gas production is expected to grow by low-single digits in FY25, supported by ongoing development projects at ONGC and RIL.

However, this growth may slow as RIL's Krishna-Godavari Basin field approaches peak production.

The domestic gas sector saw a 6 per cent production increase in FY24, driven by strong demand from city gas distribution (CGD) companies.

LNG imports, which grew by 16 per cent in FY24, are expected to rise further by mid-to-high single digits in FY25 due to increased demand and moderated international gas prices.

Petroleum product demand is projected to rise by mid-single digits in FY25, driven by strong growth in automobile sales, infrastructure spending, and economic expansion.

FY24 saw a 5 per cent increase in demand as GDP grew by 8.2 per cent. Diesel and petrol sales experienced significant growth, driven by commercial-vehicle demand and increased travel, respectively.

Exports of petroleum products rose by 2 per cent in FY24 after a decline in FY23.

State-owned OMCs are expected to retain their dominance in the fuel retail market, expanding their outlet share to 90.4 per cent by May 2024 from 89.9 per cent in March 2022.

The private sector has taken a more cautious approach due to volatile crude prices and stagnant retail fuel prices for much of FY23-FY24.

The number of compressed natural gas (CNG) stations in India has grown significantly, from around 1,300 in early 2018 to 6,861 by April 2024, with continued high growth expected due to favorable investment plans and CNG's cost advantages over liquid fuels.

The downstream oil and gas industry involves refining crude oil into consumable products and marketing them. On the other hand, in the oil and gas industry, upstream refers to the exploration and production of crude oil and natural gas. (ANI)

36

36